In the realm of Australian real estate, patience truly is a virtue. While short-term market fluctuations often dominate conversations at weekend barbecues and media outlets, Australians should take a longer view when it comes to their residential property investments. A recent study revealed that the median hold period for homes sold over the past year was a substantial nine years, showcasing a tendency towards long-term ownership rather than short-term flips. Property, unlike shares and other assets, has high costs to entry/exit such as stamp duty, agent’s commissions and marketing fees. This is another reason why it should be viewed as a medium to long-term investment and allow for capital gain to compensate for these costs.

Despite the buzz surrounding the recent surge in housing values during the pandemic and subsequent softening as interest rates climb, it’s essential to take a step back and reflect on the broader trends shaping the real estate landscape over the past three decades.

Over this 30-year span, we’ve witnessed six distinct cycles of growth and decline in the national property index. Each phase has been marked by unique catalysts, including shifts in taxation policy, monetary decisions, economic shocks, fiscal stimuli, and broader economic conditions.

While the market ebbs and flows, the overarching trend remains upward. Nationally, dwelling values have soared by a staggering 382% since July 1992, representing an average annual increase of 5.4% p.a.

Delving deeper into the decades, the period from 1992 to 2002 stands out as the most fruitful, with national home values surging by 77%. The following decade (2002-2012) saw a respectable 59% increase, while the most recent decade witnessed a robust 72% rise.

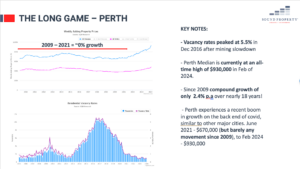

However, geographical disparities abound, influenced by local market dynamics. For instance, Perth experienced a housing boom and subsequent downturn due to the mining industry’s fluctuations. For the period between 2009 – 2021, Perth basically record 0% growth. It’s only in recent years post COVID that the market, like many others around the country, recorded decent growth. Taking this growth into consideration, Perth has still only achieved around 2.4% p.a compound growth in prices, which is well below the long-term benchmark for a “Sound” investment property.

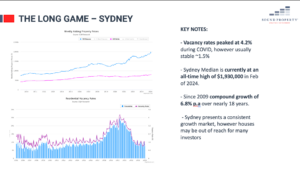

Sydney, on the other hand, has been a far more consistent perfomer, although possibly out of reach for most investors budgets at current levels. In Sydney, dwelling values have skyrocketed by 449% over the past three decades, translating to substantial gains in dollar terms. Similarly, Melbourne boasts the highest long-term growth rate, with the Yarra region leading the charge in capital gains.

This all underscores the importance of understanding regional nuances and long-term market dynamics. As the research shows, average hold periods are 9 years, so assessing markets in any less of a period is a short-sighted, and potentially risky, investment decision.

Moreover, the performance gap between houses and units is notable, with houses generally outpacing units in value appreciation. This discrepancy reflects the scarcity value of land and its impact on housing values over time.

Looking at the capital cities versus regional areas, capital cities have experienced higher growth rates, attributed to increased demand and limited supply. Melbourne takes the crown with the highest 30-year growth rate, followed closely by Sydney.

Brisbane, too, has witnessed impressive growth, particularly in its Inner East region, where house values surged by 613% over the past 30 years.

In order to achieve the best investment results for clients and reduce risk there are some features we would usually look for:

- House over a unit – better long-term growth and less chance of over supply

- East coast Capital city or major regional hub – more stable growth and less volatile

- Low vacancy rates – ensure maximum occupancy and highest rental yields

- Suburb with high owner occupier demand – generate the best resale values

- Low supply fundamentals – no greenfield land estates or high density zones

In order to secure strategic property investments for our clients, here are the 15 Key Investment Drivers we look at to maximise results and minimise risk.

In essence, while short-term fluctuations may capture headlines, the enduring lesson is clear: time in the market outweighs timing the market. By understanding the long-term trends and market dynamics, investors can navigate the Australian property landscape with confidence and clarity.