Sort the Fact from Fiction in the Property Market: How to Avoid Media Induced Hype

Introduction:

The allure of investing in property is undeniable. With promises of lucrative gains and long-term security, it’s no wonder that many individuals are drawn to the property market. However, amidst the genuine opportunities lie the pitfalls of media-induced hype. Sensational headlines and clickbait stories often exaggerate the potential gains, leading investors down a path of unrealistic expectations and financial risks. In this article, we’ll explore how to navigate the property market and avoid falling victim to media-induced hype.

Research, Not Headlines:

There are many things to consider when assessing the potential of an investment property, including where to buy. The media may report on the ‘Australian Property Market’ as a single entity, however, Australia consists of thousands of property markets, doing different things, at different times.

There are various national economic factors such as consumer confidence, interest rates, unemployment and wage growth that influence the markets at large, however, there are many other drivers such as supply levels and affordability that can make an individual market move in its own cycle.

Sound Property has developed an innovative research model that involves a ‘top-down’ approach across three tiers of research. The 15 Key Investment Drivers identify the best markets and property for growth and rental yield, and help reduce risk.

Sound Property’s Suburb Profile Reports provide the key facts on any suburb in Australia, from a variety of trusted sources, to identify the best markets for growth and rental yields and help avoid costly mistakes – Order one here

Question the Narrative:

Media outlets often frame stories to attract attention and generate clicks. While catchy headlines may pique your interest, it’s essential to question the underlying narrative. Are the reported gains realistic? What are the potential risks involved? By adopting a critical mindset, you can discern between exaggerated hype and genuine opportunities. Seek out diverse perspectives and consider the broader context before jumping into any investment decision.

Distinguish Between Market Trends and Fads:

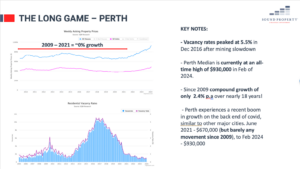

Property markets are subject to fluctuations influenced by various factors such as economic conditions, regulatory changes, and demographic shifts. While media hype may spotlight short-term spikes or hot trends, it’s essential to distinguish between genuine market trends and passing fads. Avoid making impulsive decisions based on temporary hype and instead focus on long-term sustainability and growth potential. Geographical disparities abound, influenced by local market dynamics. For instance, Perth experienced a housing boom and subsequent downturn due to the mining industry’s fluctuations. For the period between 2009 – 2021, Perth basically record 0% growth. It’s only in recent years post COVID that the market, like many others around the country, recorded decent growth and is taking out many media headlines. However, taking this recent growth into consideration, Perth has still only achieved around 2.4% p.a compound growth in prices, which is well below the long-term benchmark for a “Sound” investment property.

Embrace Prudent Risk Management:

Every investment carries inherent risks, and property is no exception. While media hype may emphasize the upside potential, it’s crucial to acknowledge the downside risks and implement prudent risk management strategies. Diversify your investment portfolio, maintain a buffer for unexpected expenses, and conduct thorough due diligence before committing to any property purchase. By adopting a cautious approach, you can mitigate risks and safeguard your financial interests.

Stay Grounded in Reality:

In the age of social media and viral content, it’s easy to get swept up in the excitement of sensational stories and inflated promises. However, it’s essential to stay grounded in reality and maintain a rational perspective when evaluating property investments. Set realistic expectations, avoid chasing speculative opportunities, and prioritise long-term sustainability over short-term gains. Remember that wealth accumulation through property investment requires patience, discipline, and sound decision-making.

Conclusion:

Navigating the property market can be a daunting task, especially amidst media-induced hype and sensationalism. By conducting thorough research, questioning the narrative, distinguishing between market trends and fads, embracing prudent risk management, and staying grounded in reality, investors can avoid falling victim to media hype and make informed decisions that align with their financial objectives. Ultimately, success in property investment lies not in chasing headlines but in adopting a disciplined and strategic approach to long-term wealth creation.