A property buyer’s agent can provide several benefits to individuals or investors looking to purchase a property such as expertise and market knowledge, time and effort savings, access to off-market property, negotiation skills, objective advice and connection to a network of other industry professionals.

As the trusted buyer’s agency for strategic property investment Sound Property can provide valuable insights and help you make informed decisions, ultimately maximising your results, whilst minimising risk.

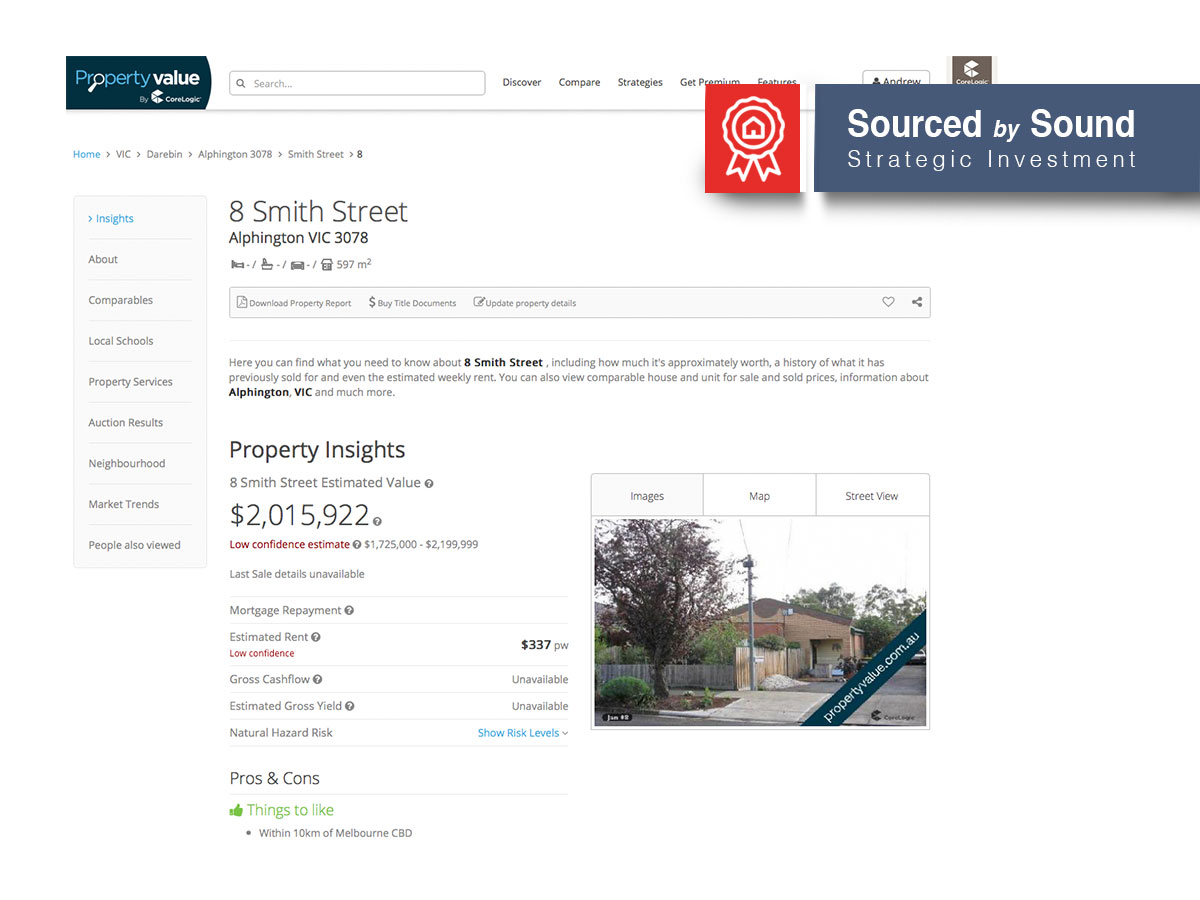

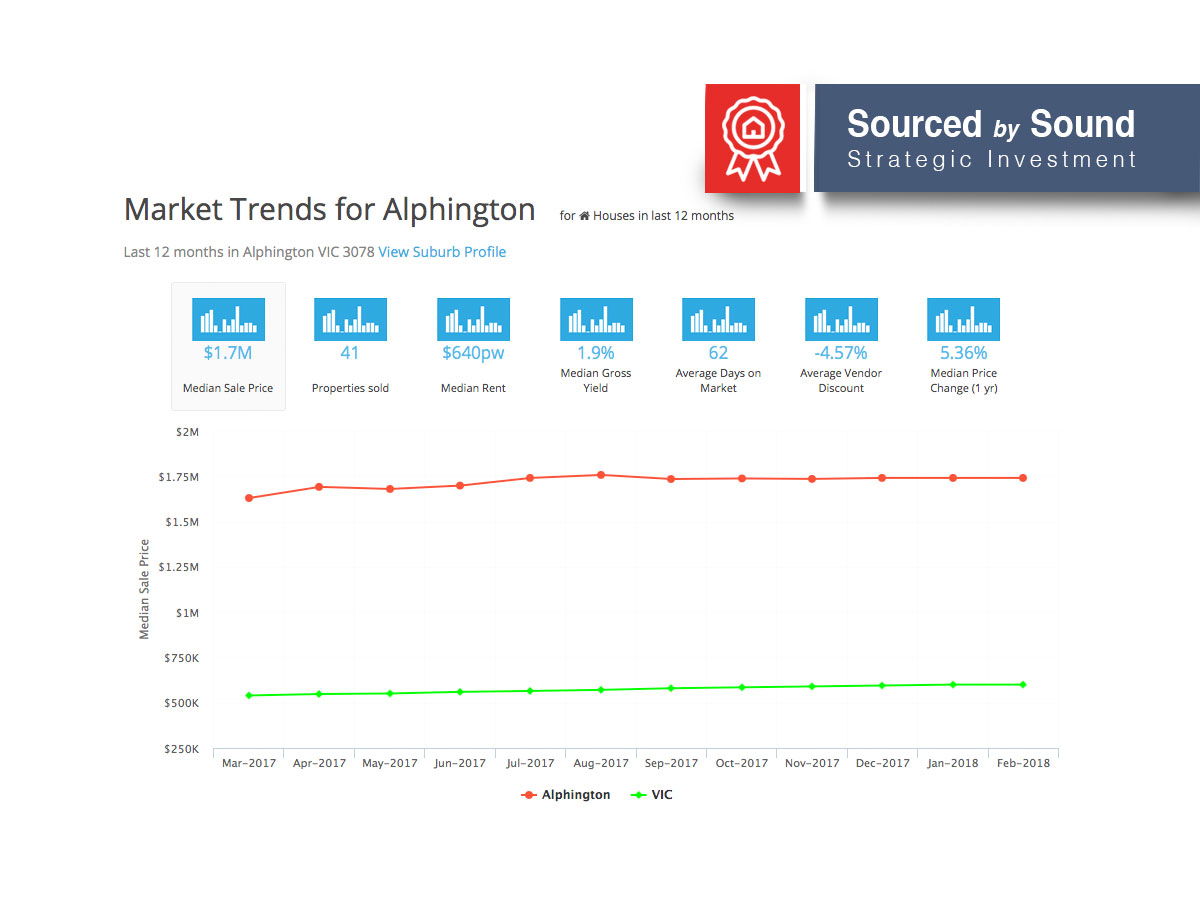

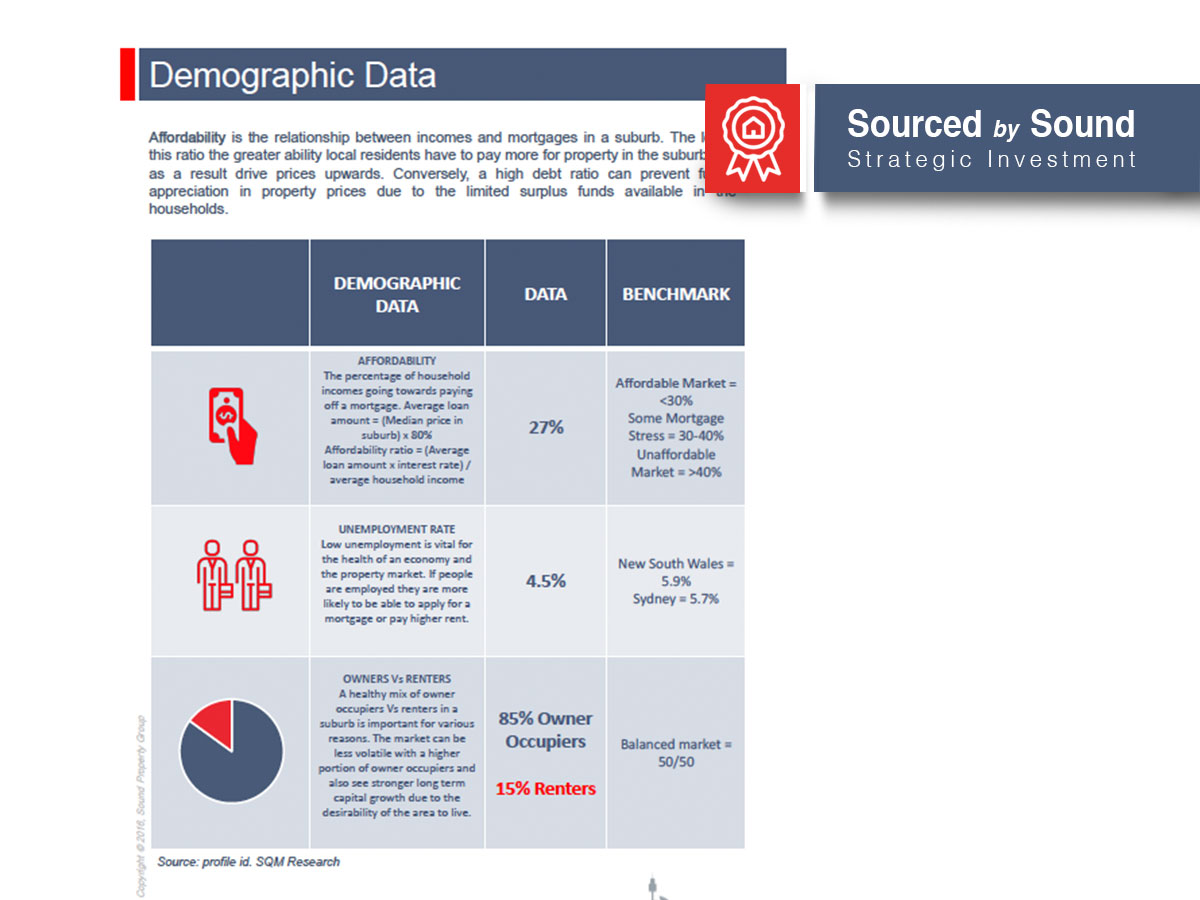

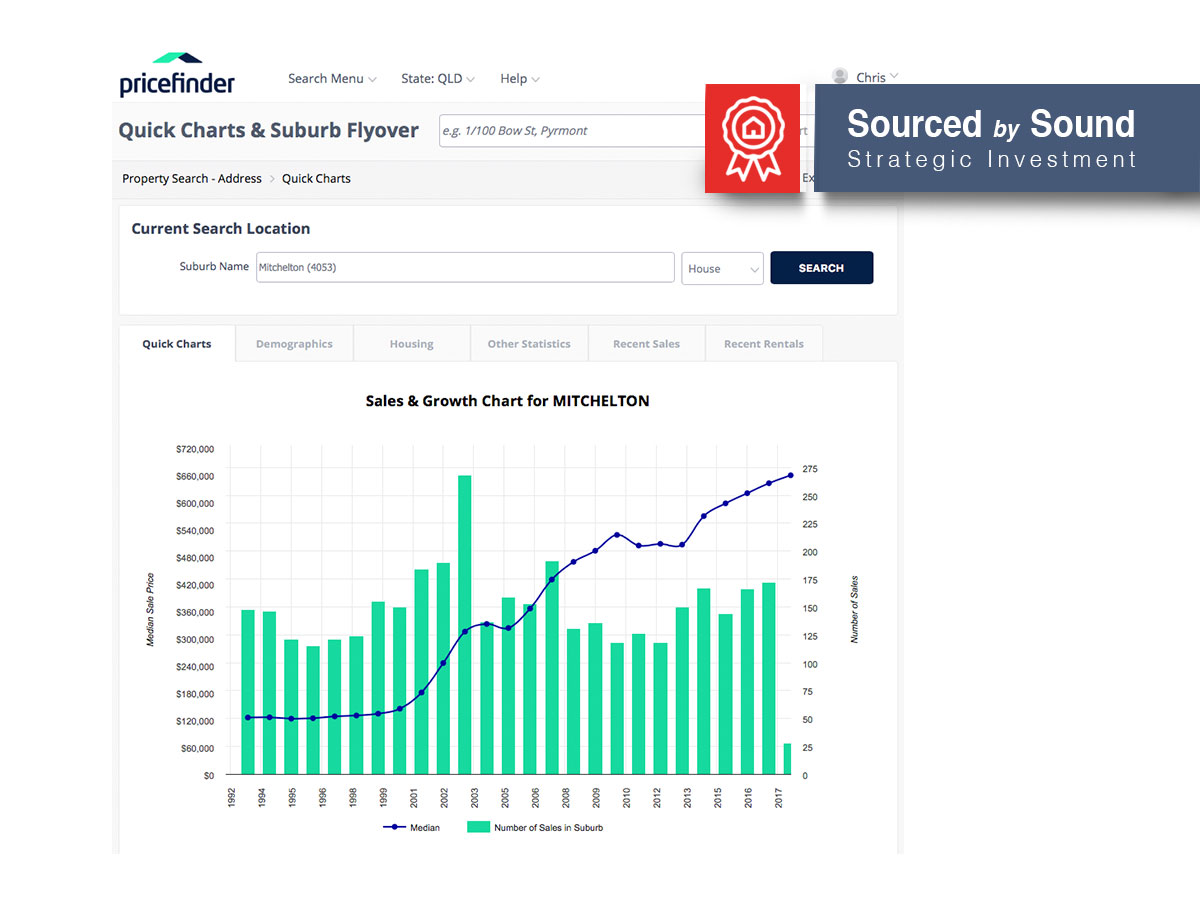

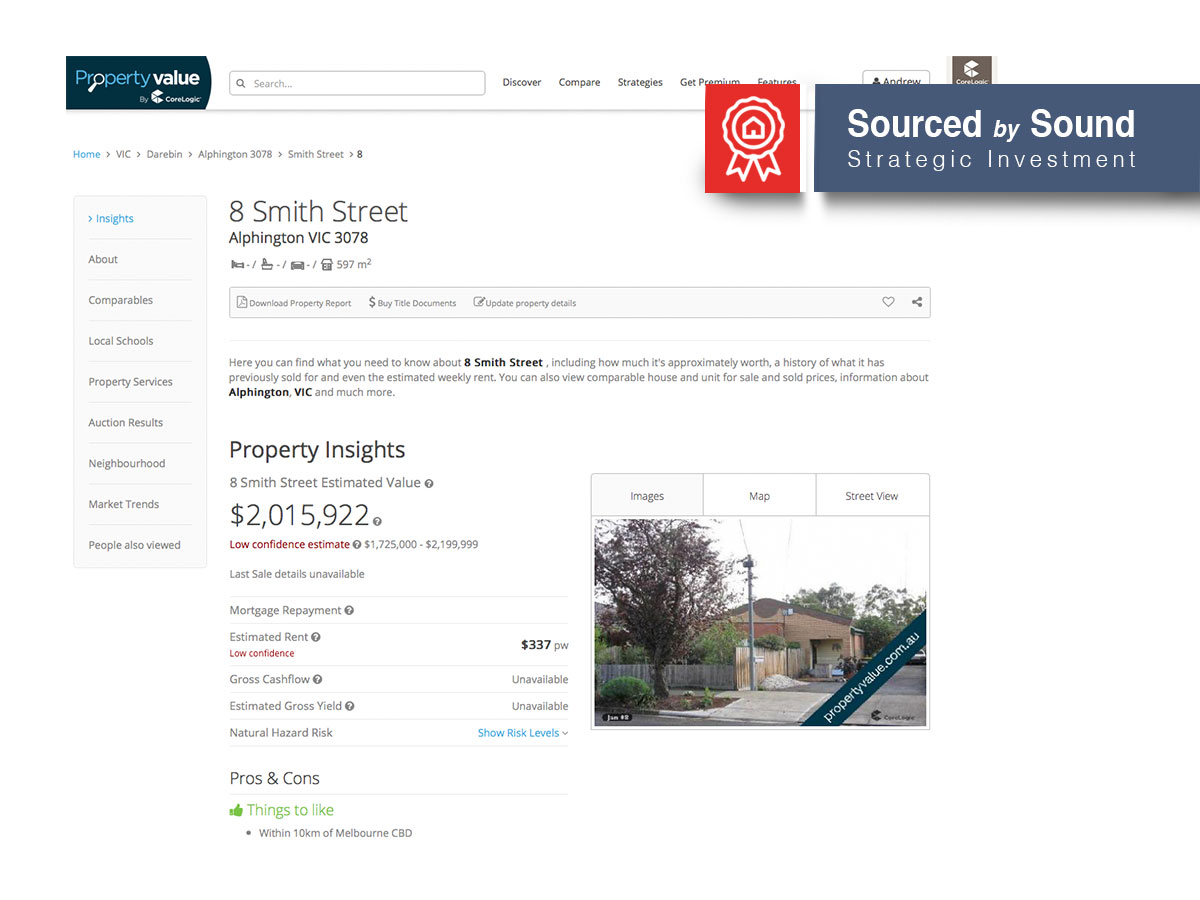

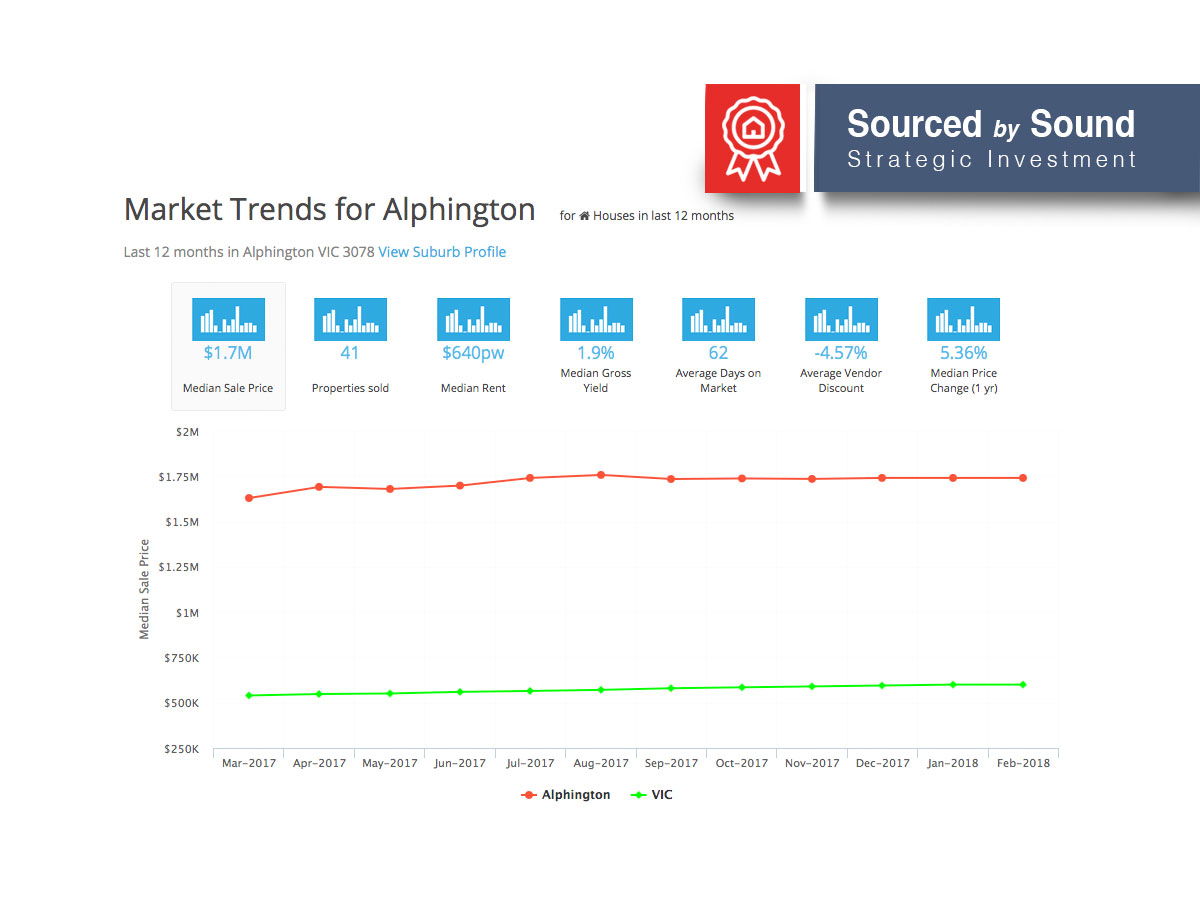

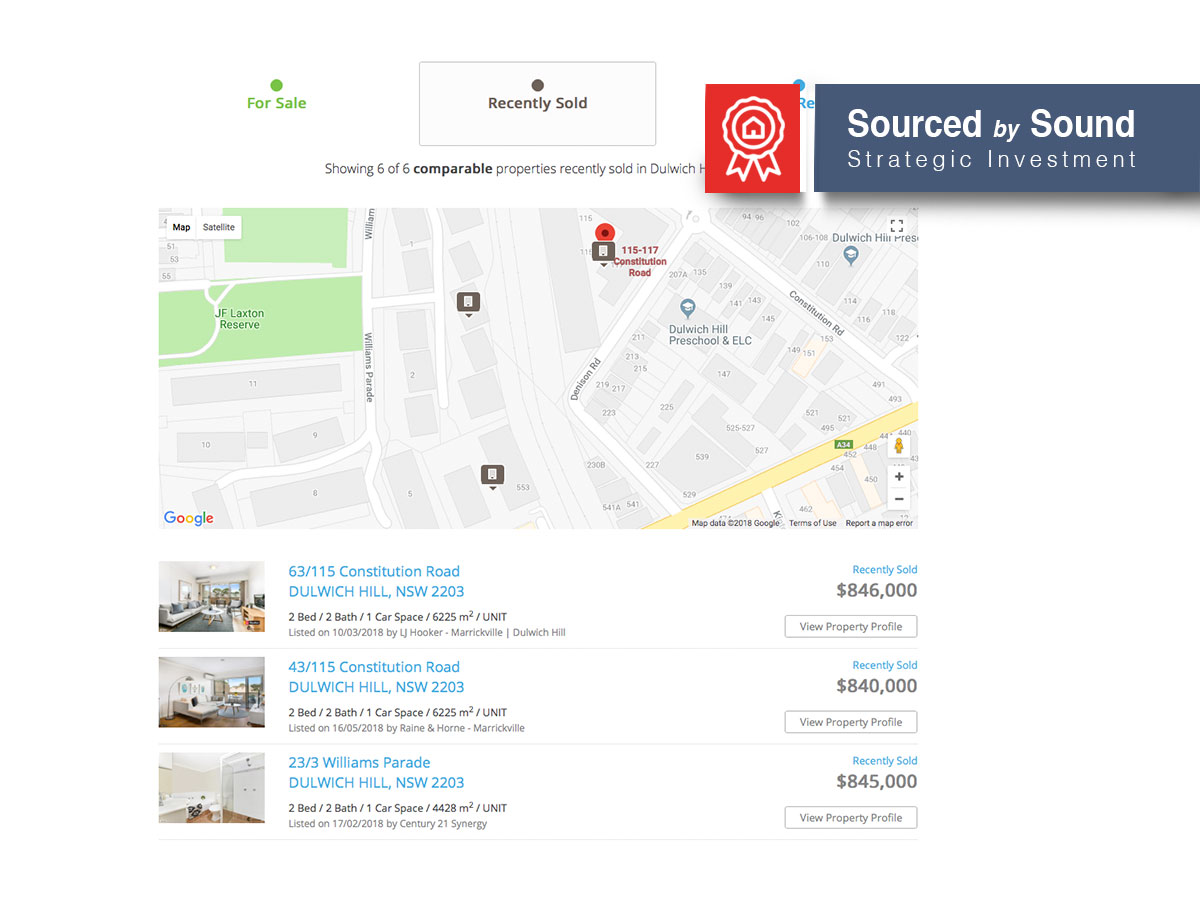

1. Expertise and Market Knowledge: A buyer’s agent has in-depth knowledge of the local real estate market, including current property values, market trends, and neighborhood information. They can provide valuable insights and help you make informed decisions.

2. Time and Effort Savings: Searching for the right property can be time-consuming and overwhelming. A buyer’s agent can save you time by conducting property searches, arranging viewings, and handling negotiations on your behalf. They have access to a wide range of resources and networks that can expedite the buying process.

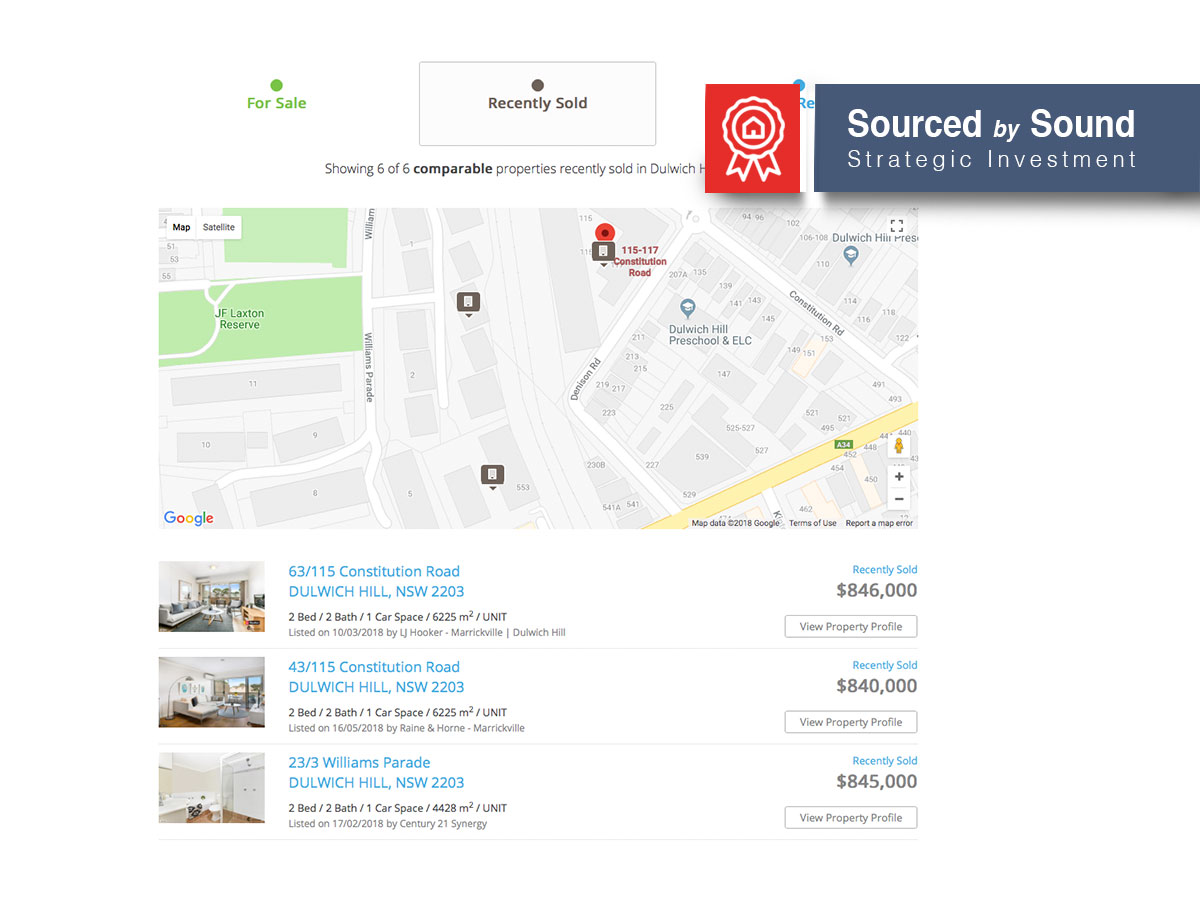

3. Access to Off-Market Properties: Buyer’s agents often have access to off-market properties or properties that are not publicly listed. This can give you an advantage in finding unique investment opportunities or properties that meet your specific criteria.

4. Negotiation Skills: Negotiating the best price and terms is a crucial aspect of property buying. A skilled buyer’s agent can negotiate on your behalf, leveraging their experience and market knowledge to secure a favorable deal.

5. Objective Advice: Buyer’s agents work solely for the buyer’s best interests, providing unbiased advice throughout the process. They can help you evaluate properties objectively, identify potential risks or issues, and guide you towards making sound investment decisions.

6. Network of Professionals: Buyer’s agents often have established relationships with other professionals in the industry, such as real estate agents, mortgage brokers, and property inspectors. They can refer you to trusted professionals who can assist with various aspects of the buying process.

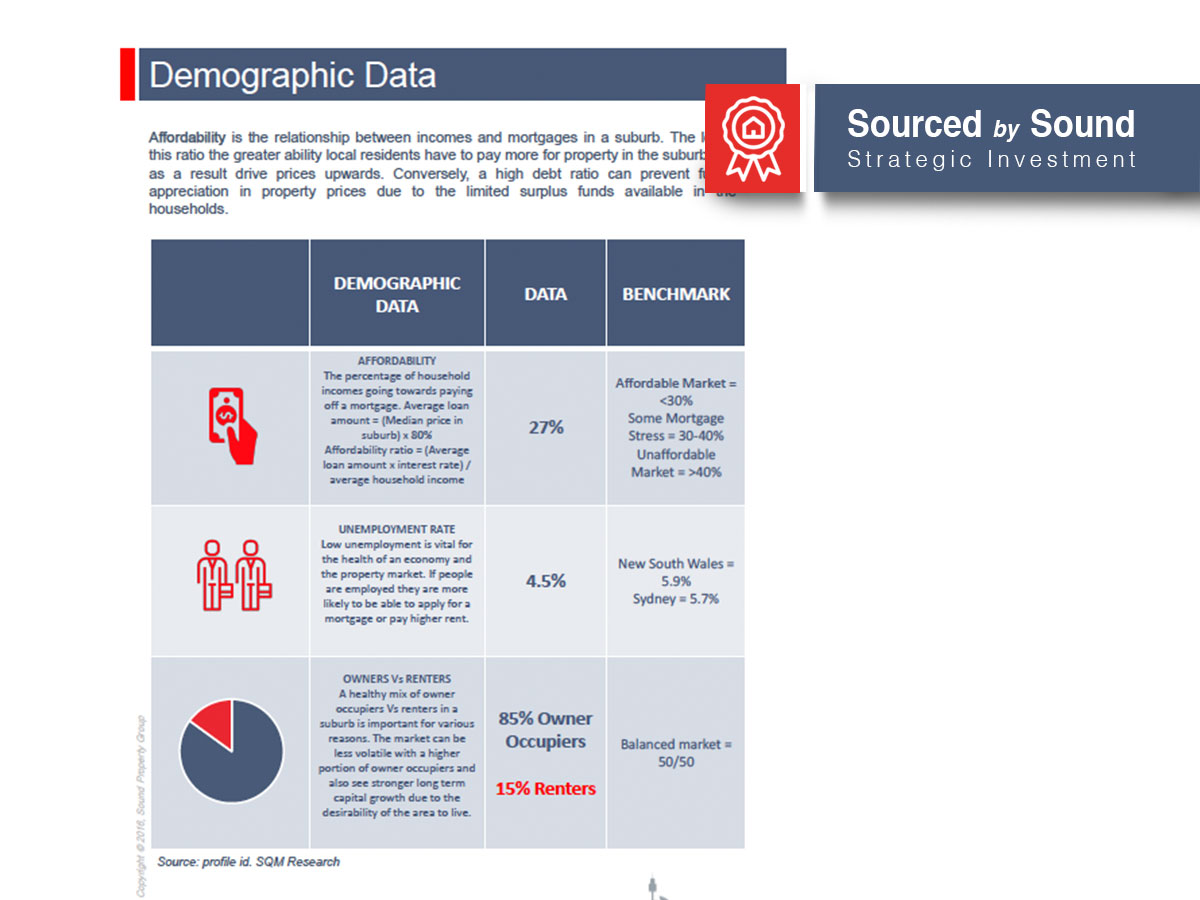

Sound Property has developed an innovative research model that involves a ‘top-down’ approach across three tiers of research.

Our 15 Key Investment Drivers framework identifies the best markets and properties for growth and rental yield. It is our mission to help people secure a high performing investment.

Excellent service and thorough analysis to suit our needs. Sound Property has been amazing throughout the process of researching postcodes for us, and recommending a property.

David L.

Had a great interaction with Sound Property. Really switched on people that did whatever it took to get a great result on behalf of their buyers. Daniel and his team were a delight to work with.

Paula B

Sound Property helped me to secure a property for my SMSF. I needed secure income with growth at a lower price point. They knocked back properties they didnt think would be good value for me and negotiated a good deal on one they did think would be a good fit for me. I would highly recommend!!

Brian B

Incredible service - so happy with Andrew Cull and all the team at Sound Property. Couldn't have asked for a better experience. Throughly recommended.

Danielle L

Expats investor looking for a property that offers both strong rental yield and significant growth potential.

Duplex with modern finishes located within minutes to all local services, amenities and parkland. Being a duplex, this property has no body corporate or strata fee.

Modern & low maintenance 3+ bedroom home with future development potential

Beautifully renovated home located on a premium family-orientated street. Opportunity to hold as a rental or to subdivide into two blocks of land.

3 bed 2 bath home in a family-friendly suburb while providing excellent rental demand.

Neat and well maintained low set brick home located near local parks and school in a hotly contested rental market.

Low maintenance house, preferably closer to the CBD.

Modern and spacious family home that benefits from strong growth potential with future subdivision potential.

SMSF purchase requiring a set and forget property with a strong yield. Preferring some degree of renovations ensuring no work is needing to be done for the foreseeable future.

Highly desirable area, family friendly, low vacancy rates with lots of competition for potential tenants, higher yielding area, low maintenance property perfect for a SMSF.

Low maintenance set and forget investment property, preferably a house.

Well-maintained property with updated modern appeal, achieving a strong 4% yield in a historically high-growth suburb.

Looking for a low-maintenance, preferably a 3+ bedroom house, with 4% rental yield.

Low maintenance brick home, had partial renovations, on a good size regular block and wide frontage.

A SMSF requiring a renovated low-maintenance set and forget property.

Low maintenance brick home in a hotly contested rental market, potential to value add in the future with strong rental return.

Low maintenance property with strong long-term growth potential and the added benefit of land subdivision opportunities.

An off-market opportunity allowed us to secure a low maintenance property well below market value. Located close to CBD, airport and hospitals.

Low maintenance set and forget investment property, preferably a house.

An off-market opportunity allowed us to secure a renovated property well below market value. The recent renovations reduce the likelihood of future maintenance, ensuring peace of mind for the owner. A true win for our strategic investor.

Repeat client engaged Sound Property to manage and deliver profit on the development of two high-end homes in a blue-chip suburb.

Located across the road from a popular park, the original house sat on 2 lots for an easy knock-down rebuild project. Sourced, managed, and delivered by the Sound team for our time-poor client.

Repeat client seeking a fixer-upper in a family-friendly suburb. Add-value through renovations and extra floor plan.

This former, run down 3-bedroom house was a prime renovation opportunity - great bones and scope to add value.

Looking for a low-maintenance property with a yield of 4.2% or more.

Located in a desirable neighbourhood with a low vacancy rate of 0.8% and strong 7.55%p.a. long term growth. The recent renovations, lower the likelihood of any maintenance required.

Our most lucrative investment strategy for an investor looking for a more 'active' strategy than our usual 'buy and hold' buyer's agency work.

Sourced, secured, managed and delivered by the team at Sound Property for our time poor business owner.

Repeat client engaged Sound Property to manage and deliver profit on the development of two high-end homes in a blue-chip suburb.

Located at the high point of a prestigious street, the original house sat on 2 lots for an easy knock-down rebuild project. Sourced, managed, and delivered by the Sound team for our time-poor client.

High-yielding & low maintenance investment property.

Neat and well maintained low set brick home located near local ammenities in a hotly contested rental market with a strong 7.88%p.a. long term growth.

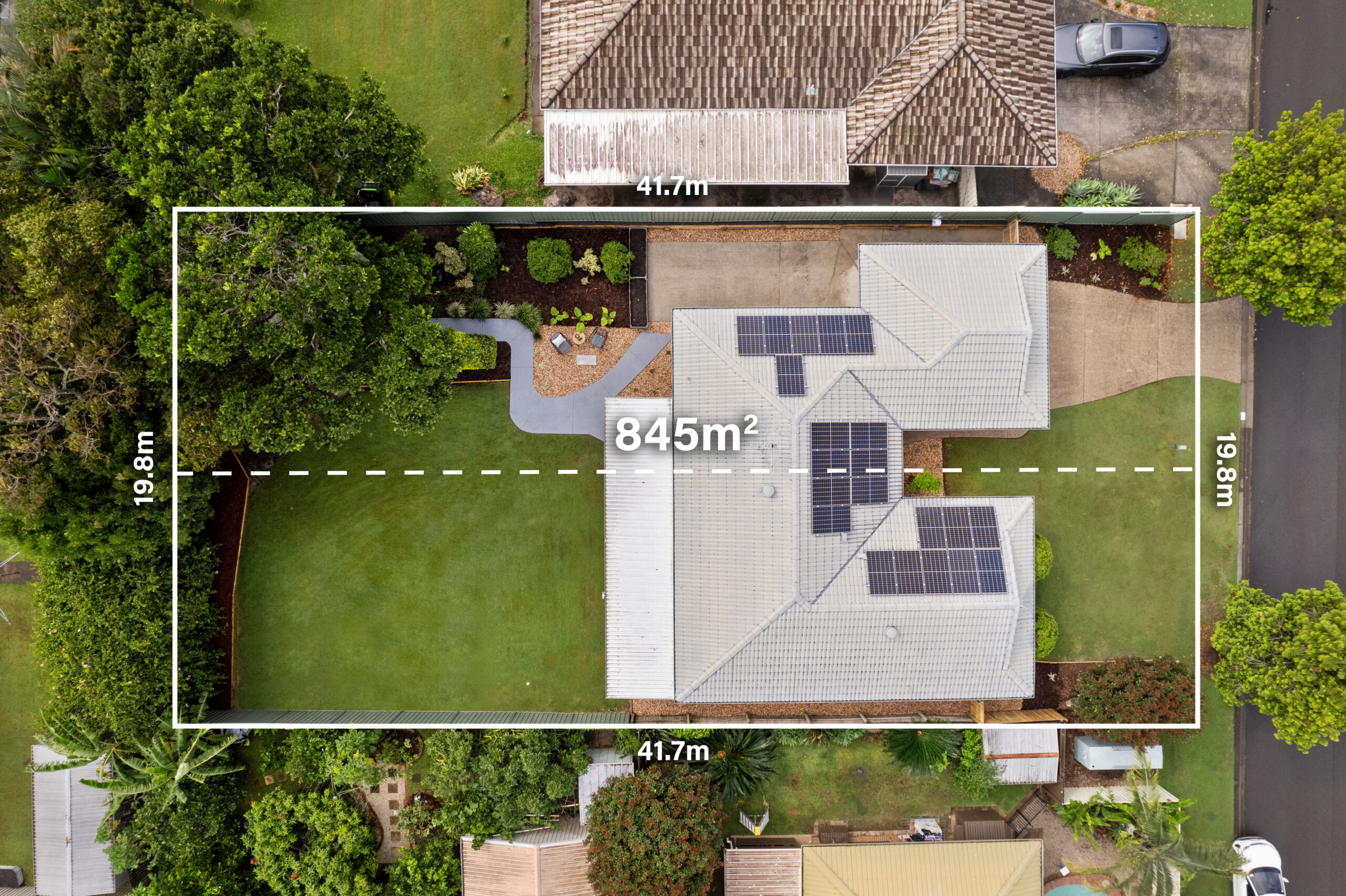

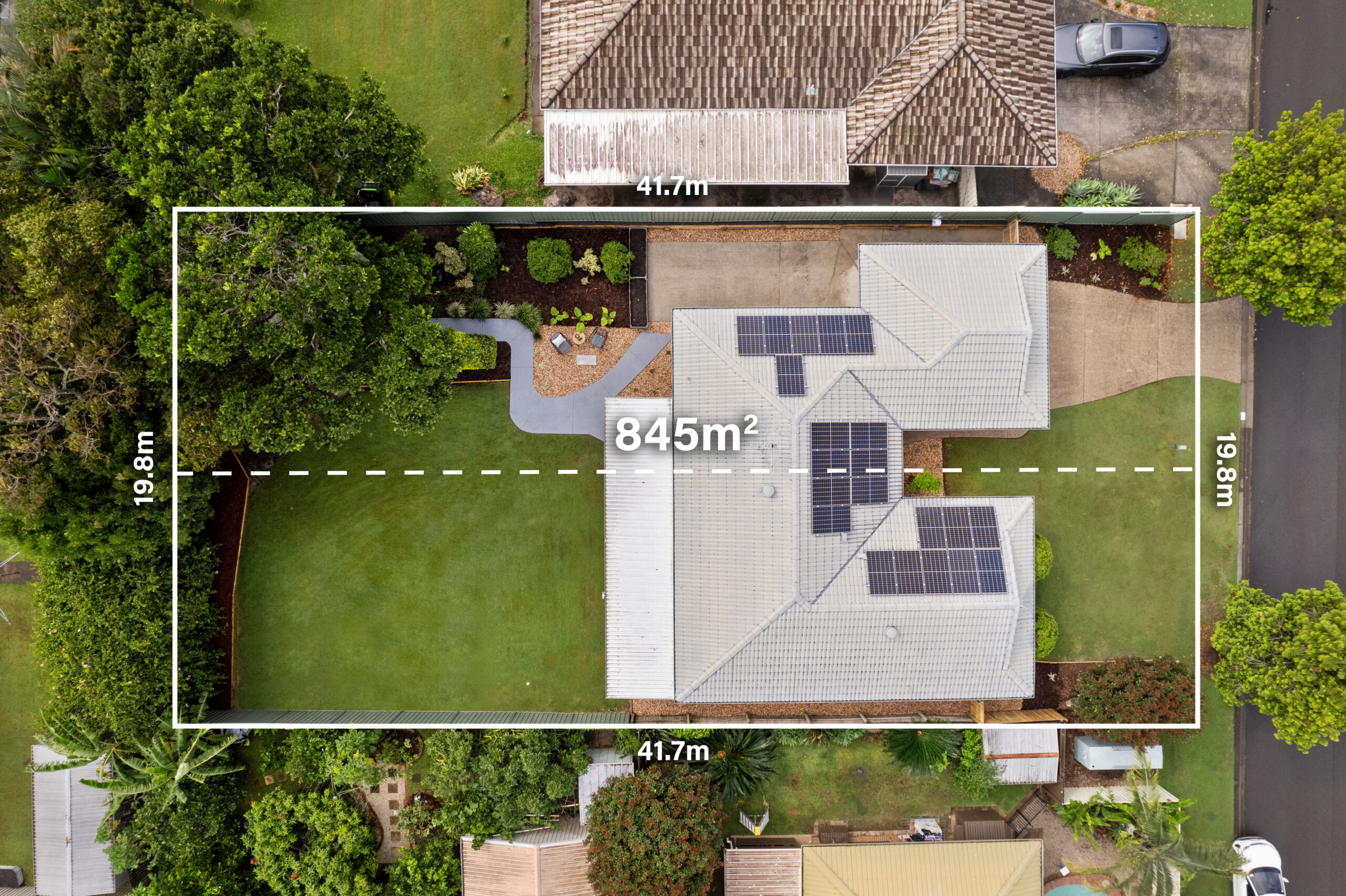

A property offering a well-maintained family home on a large block with subdivision potential. Providing a solid foundation for future growth and development flexibility.

Modern and spacious family home that benefits from strong growth potential and subdivision-ready zoning. The low vacancy rate, along with the area’s steady demand, enhances its long-term value as both an income-generating asset and a capital growth opportunity.

Low maintenance investment property located in a sought-after family suburb with a proven track record of strong capital growth.

Located conveniently close to the train station, shops, schools. This suburb's exceptionally low vacancy rate of 0.8% and long-term growth rate of 9.42% per annum suggests the potential for substantial appreciation in value over time.

Low maintenance house with a minimum yield requirement of 4.5%+.

What we liked: Recently renovated interiors meant strong tenant interest. Located in a suburb with strong 8.33%p.a. long term growth and a high 5% yield made this a well-rounded investment.

A well-maintained property with scope for adding value and potential subdivision STCA.

Neat and well maintained low set brick home in a quiet cul-de-sac area. Scope to add a 4th bedroom and subdivide in future.

Modern & low maintenance house with a minimum yield requirement of 4.2%+.

This property perfectly suited the client's brief, including a yield requirement of 4.2% +. With tenants already secured for the entirety of 2024, it presented an excellent opportunity with rental income assured.

An opportunity for both steady rental income and long-term capital growth.

Family-friendly home located close to shops, schools, medical centres, and other essential amenities. Recent rental appraisal of $650/pw indicated strong rental growth potentials.

Buying their first investment property, our client's focus was a strong yield to offset mortgage repayments.

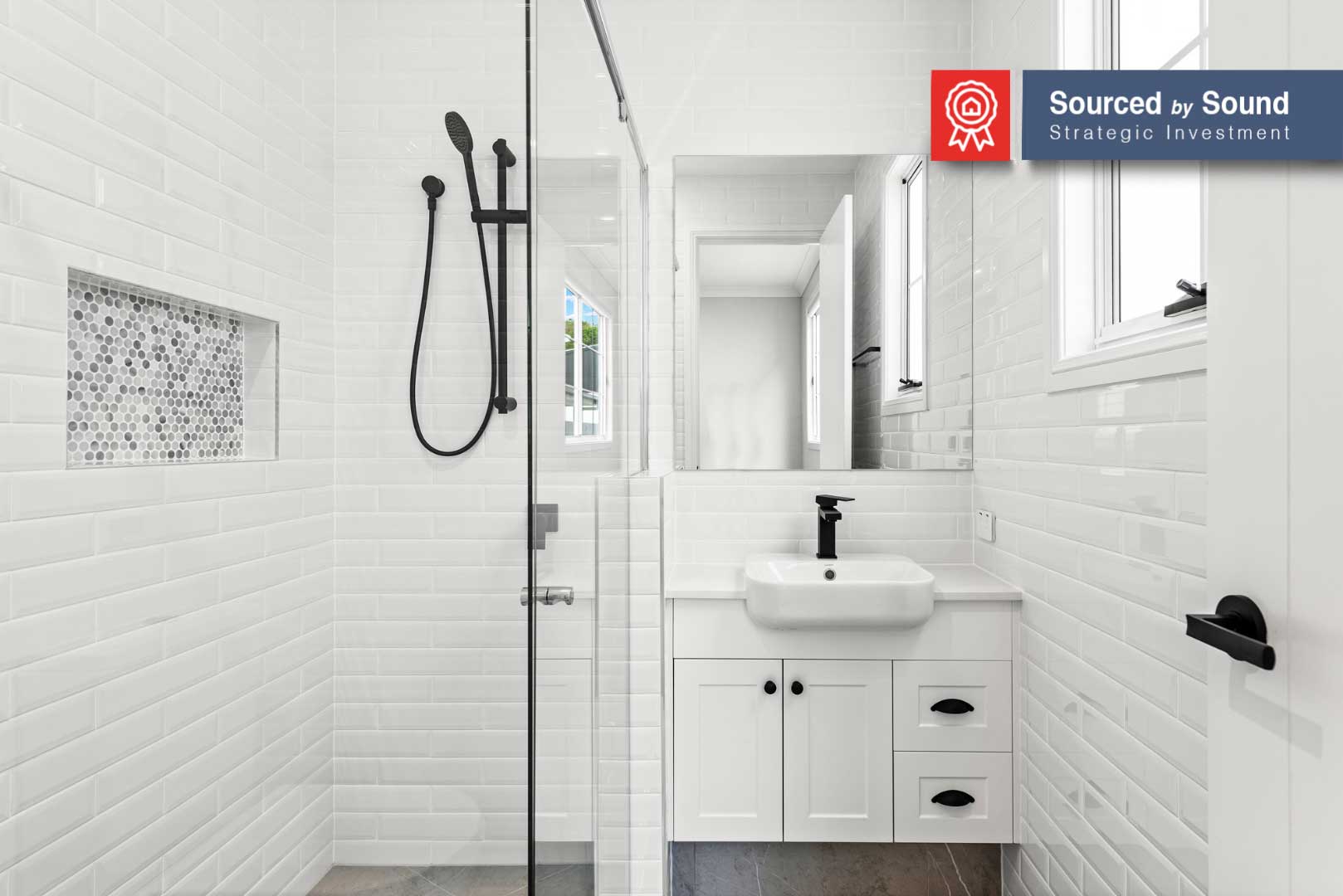

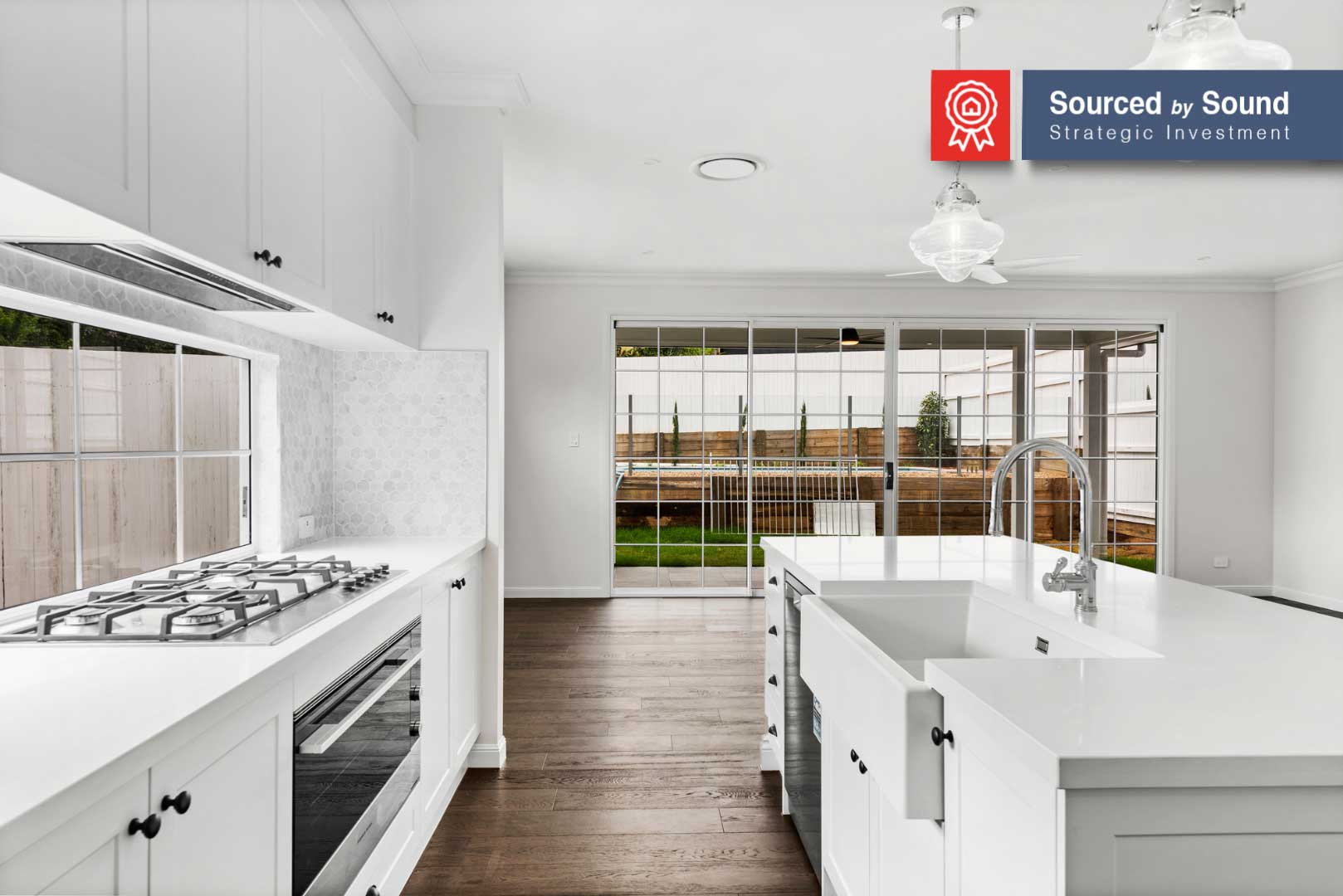

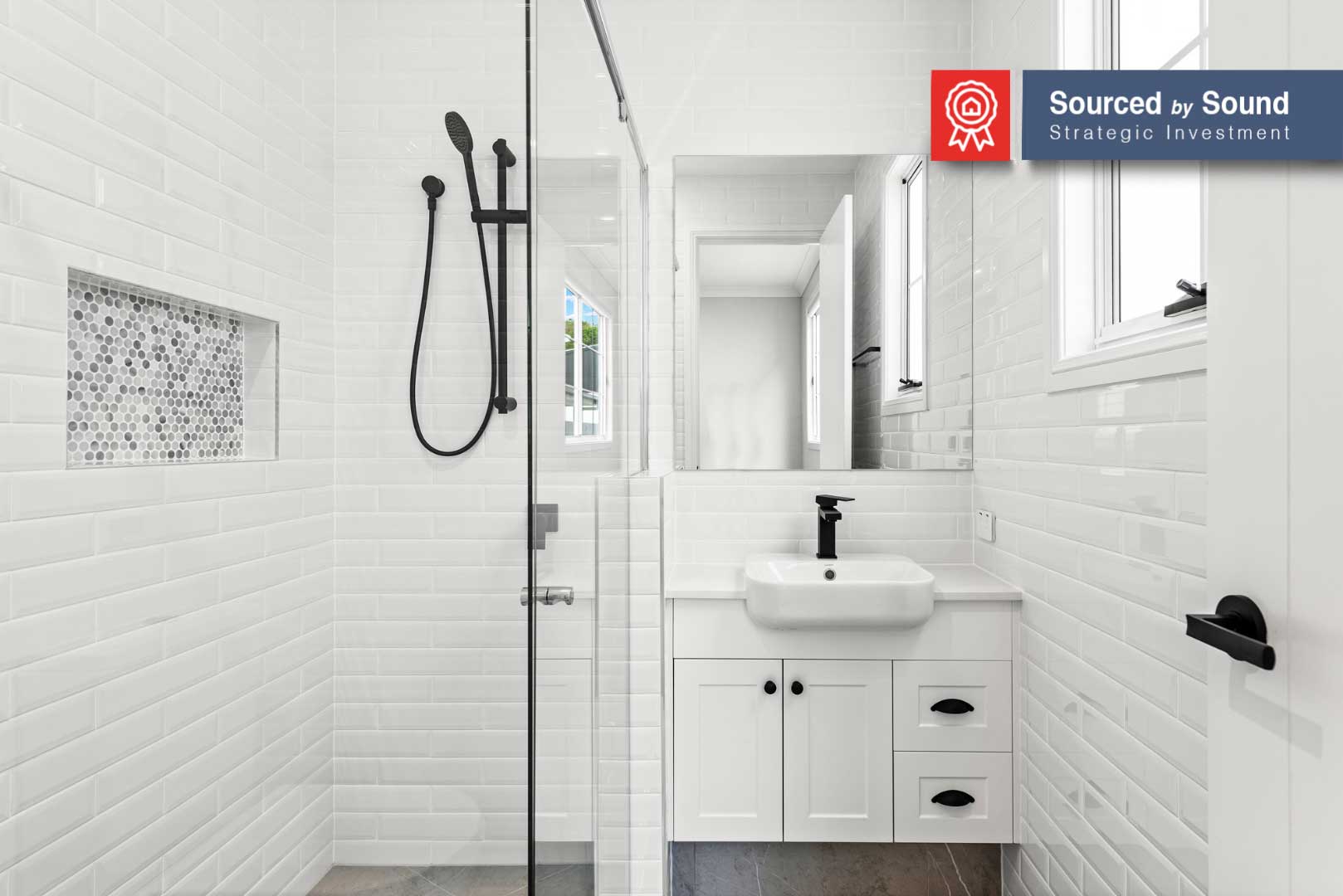

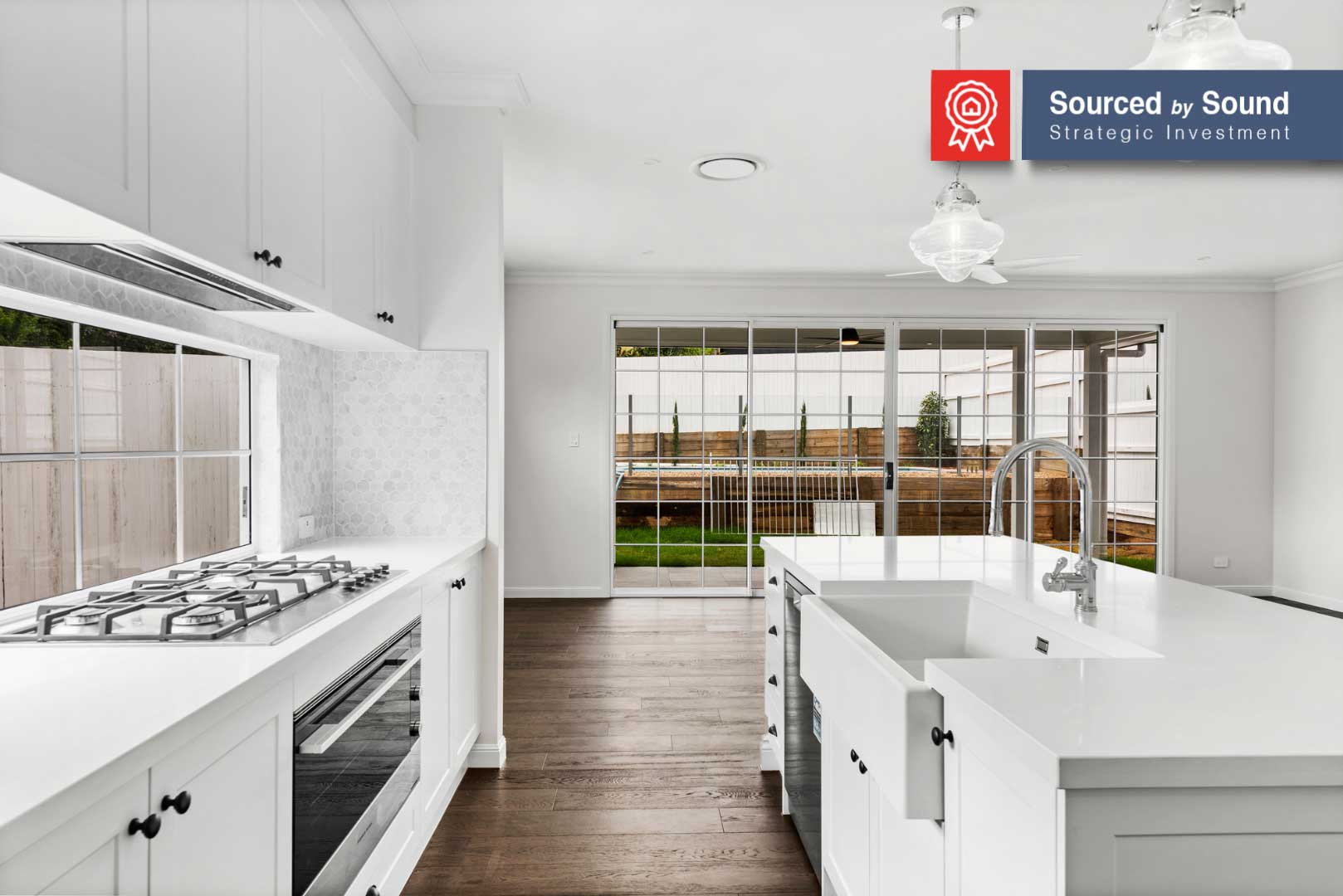

Rented before settlement for $40 per week higher than the initial appraisal. The modern kitchen & bathrooms enhanced the property's rental appeal.

The instructions from this client's Financial Planner was clear - Capital Growth!

Mission accomplished by securing this large double block with future subdivision potential, in only 2 weeks from engagement.

House with a strong holding income that can be subdivided into 2 or more blocks in the coming decade.

Well-kept family home with strong rental income. The property can be redeveloped into 3 x 405 sqm lots or 2 x 607 sqm lots whilst retaining the existing house.

Investor looking for a low-maintenance investment property in Melbourne's South East.

A low-maintenance investment in a blue-chip suburb that has a proven history of growth

An entry-level investment property located near a major infrastructure precinct.

Located around the corner from a major Westfield in a hotly contested rental market - low vacancy rates & proven history of growth above 9% p.a.

Affordable first investment with strong yield to help offset holding costs.

Rented pre-settlement meaning there was a strong holding income from day one! Low maintenance investment in a boutique TH complex.

High-yielding & low maintenance investment property

Strong 5.4% yield and rented $20 over the initial rental appraisal.

Landbank with future subdivision potential

Huge block of land with the ability to subdivide into two well-sized building blocks.

Low maintenance investment property with strong yield & growth potential

Spectacular result for our client. Achieving a capital growth rate 18.2% in just one year, well above market averages.

A rentable family home to hold for 10 years before subdividing and developing into two homes

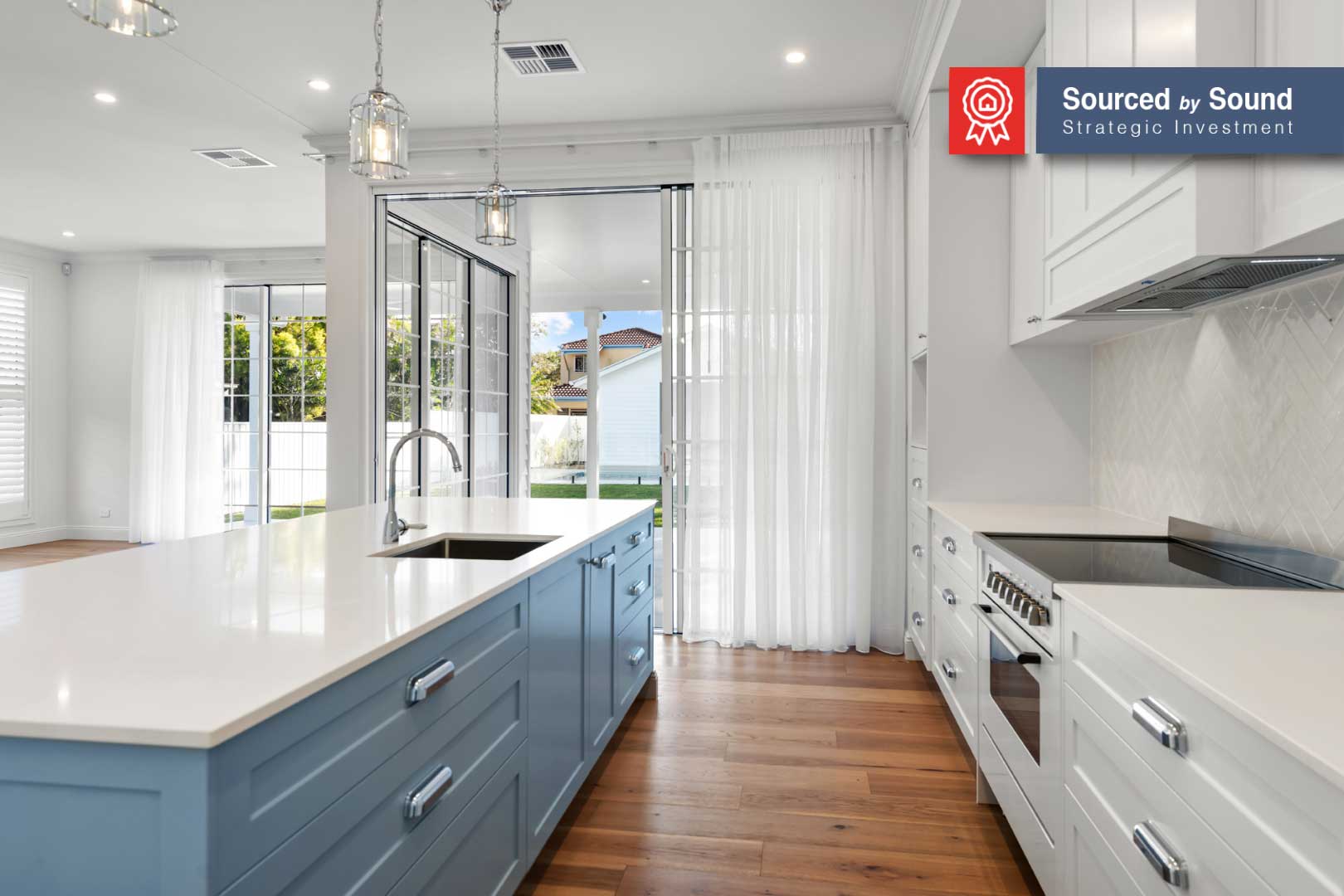

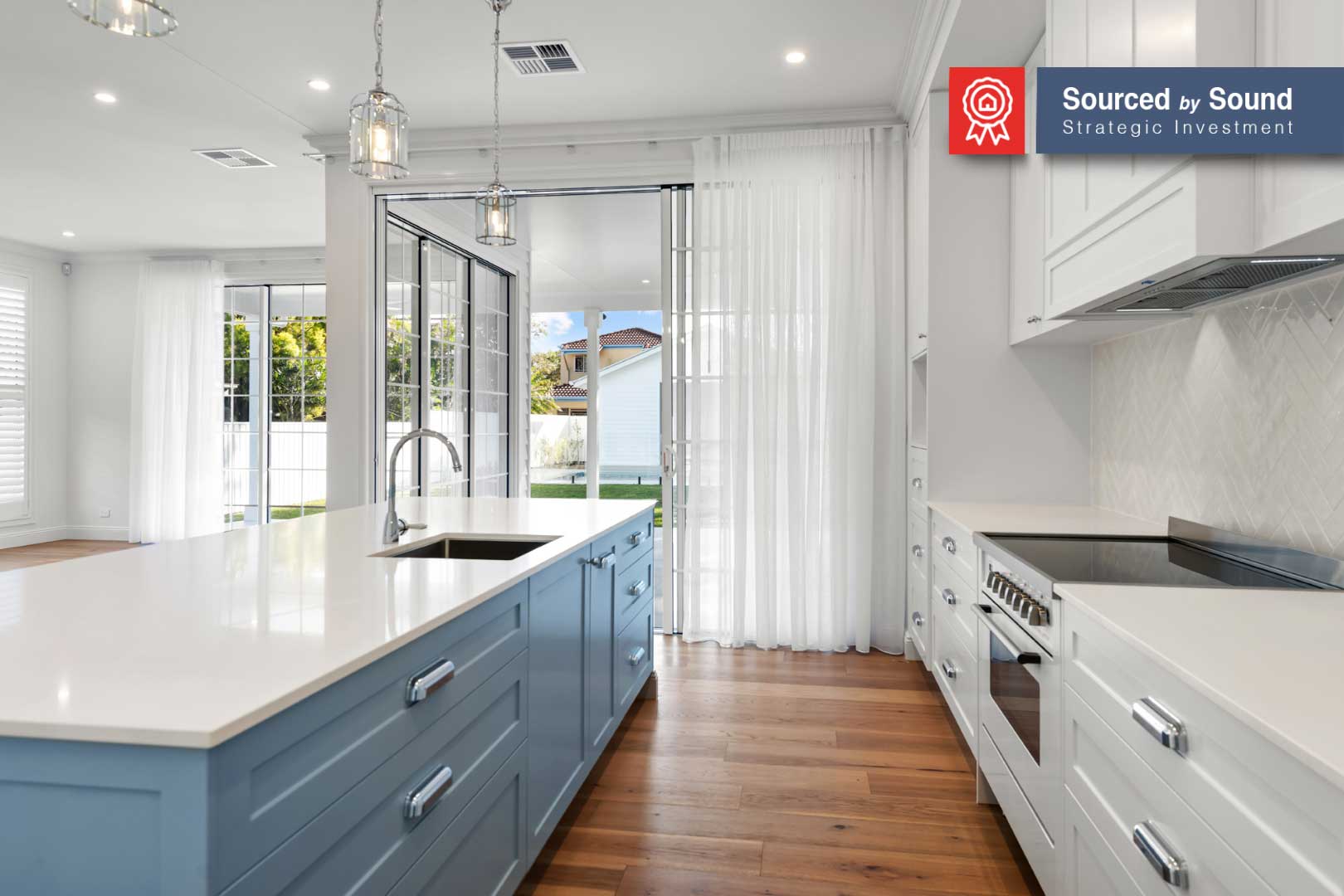

Beautifully renovated home located on a premium family-orientated street. Opportunity to hold as a rental or to subdivide into two blocks of land.

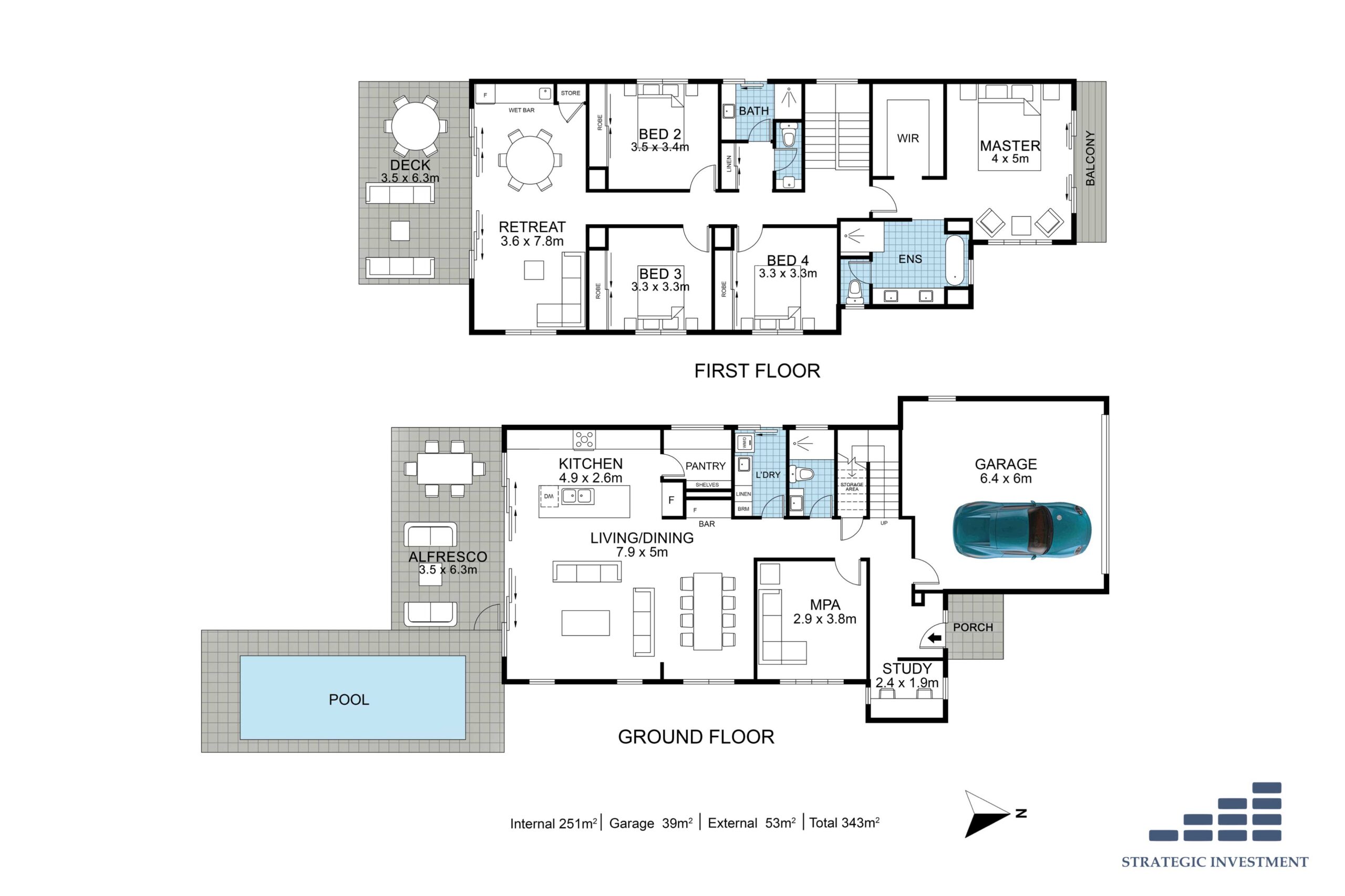

Looking for a low-maintenance purchase with a yield of 4.5% or more, preferably a 4+ bedroom house.

The strong rental yield, spacious layout and the potential for long-term growth supported by low vacancy rates from a predominantly owner-occupied suburb.

Well-balanced investment of growth and rental yield +4.5% for SMSF

Using an SMSF to buy property can be a powerful wealth creation strategy, however, can come with more complexity than other property investments.

Diversify NSW + QLD portfolio with a low maintenance investment

A proven performing suburb with a long-term growth rate of 8.36% p.a

Affordable investment property with high yield to help offset mortgage repayments

Great result for a client that's used the strategy of 'equity in their home for investment'. A property so clean there were no items to be rectified after the building and pest inspection!

Landbank opportunity with development potential in future

Rare and affordable 3-lot infill subdivision only 20km to Brisbane CBD.

Owner-occupier looking to buy a unique and quirky apartment to reside in while in Melbourne.

Character-filled 2-bedroom apartment close to the CBD, perfect to call home. Opportunity to lease in the future and benefit from the strong yield.

Low maintenance, multi-tenanted commercial property in a proven market

Massive freehold Highway corner site in an important inland city. High quality medical and pet care investment with long secure leases. Thriving, established dental tenants with recent fit-out.

Custom Built House in blue ribbon address

Short walk to public transport and popular schooling in a proven suburb for long-term growth. ~$41,000 in depreciation benefits in year 1 alone.

Vacation home in an exclusive waterfront position, with rental opportunity

A perfect lifestyle investment, compounding an annual growth rate of 22.4% since purchase. Adding up to a phenomenal gain of $1.2m.

Townhouse around $500K budget, with strong growth and high rental yield

This boutique block of only 9 x 2 + 3 Bed townhouses, 7km to a thriving CBD, were great value around the $500k mark with strong rental yields at 4.7%. The owner-occupier focus and quality of these townhouses will ensure high growth and rental demand for many years to come.

Inner city house for investment and relocation

Recently renovated and super convenient location

Custom Built House in blue ribbon address

What’s not to like about a piece of blue-chip real estate with a strong rental yield?! Only 6km CBD, walk to the train, surrounded by the top private and public schools. Tick, tick tick!

Rentvestor looking to diversify their portfolio into new markets having already bought properties in Sydney and Brisbane.

Property outperformed the market average growth rate and continues to acheive tight vacancy rates, all at an affordable price point.

Custom Built House in blue ribbon address

Another custom build comes to completion for our time-poor client. Fully sourced, managed, and delivered by the team at Sound Property®. At the long-term growth rate (past 25 years), this property is set to double in value over the next 7 years

Brand new home with full depreciation benefits to help offset income.

The strong market fundamentals. This suburb's exceptionally low vacancy rate of 0.6% indicates high demand for rental properties, while the long-term growth rate of 10.28% per annum suggests the potential for substantial appreciation in value over time.

2 x Custom Built Houses in blue ribbon address

183% return on client’s funds in 24 months = $1m gross profit before tax. On top of this great result, the client will now benefit from $2,500/w in combined rental income (5.2% yield), making the investment positive cashflow as it grows further in value.

Overseas investor wanting affordable investment property without compromising on location, budget under $600K.

This investment ticked all the right boxes, with suburb achieving consistent capital growth in the last 15 years. The property features and location are attractive to renters, which ensure a good rental return. Since this was a brand new property, tax deductions were also maximised.

Custom Built knockdown/rebuild

Another custom build comes to completion for our time-poor client. Fully sourced, managed, and delivered by the team at Sound Property®. At the long-term growth rate (past 25 years), this property is set to double in value over the next 7 years.

2 x Custom Built House and Land in blue ribbon address

Nestled on the side of a hill with sweeping district views. These houses feature a seperate self-contained unit downstairs. Only 6km to the CBD in a blue ribbon postcode with solid long-term growth.

Premium Custom Built House and Land in high demand suburb

Only 6km to the CBD, this blue-ribbon address in a high demand suburb has been consistently achieving 11% capital growth p.a for the past 15 years. Clients made some solid inbuilt equity by the time the property was complete and will prove a strong long-term buy and hold

Custom Built knockdown/rebuild in blue ribbon address

Another custom build comes to completion for our time-poor client. Fully sourced, managed, and delivered by the team at Sound Property®. At the long-term growth rate (past 25 years), this property is set to double in value over the next 7 years.

Premium Custom Built House and Land in high demand suburb

Exhibit A and B – Helping to grow wealth through strategic property investments. Perched at the top of a hill overlooking the water, CBD, and mountain ranges. Looking back less than two years this raw land was a bargain.. at the time it was the record price for the suburb!

Low risk, blue chip, buy and hold house and land in desirable community

A blue ribbon, affluent demographic on the Sunshine Coast. Extremely tight vacancy rates, strong rentals and booming infrastructure projects make this a solid buy and hold.

Investor with 2 units on the Gold Coast and 2 houses in Perth wanting to assess risk in current portfolio and unlock equity to continue investing.

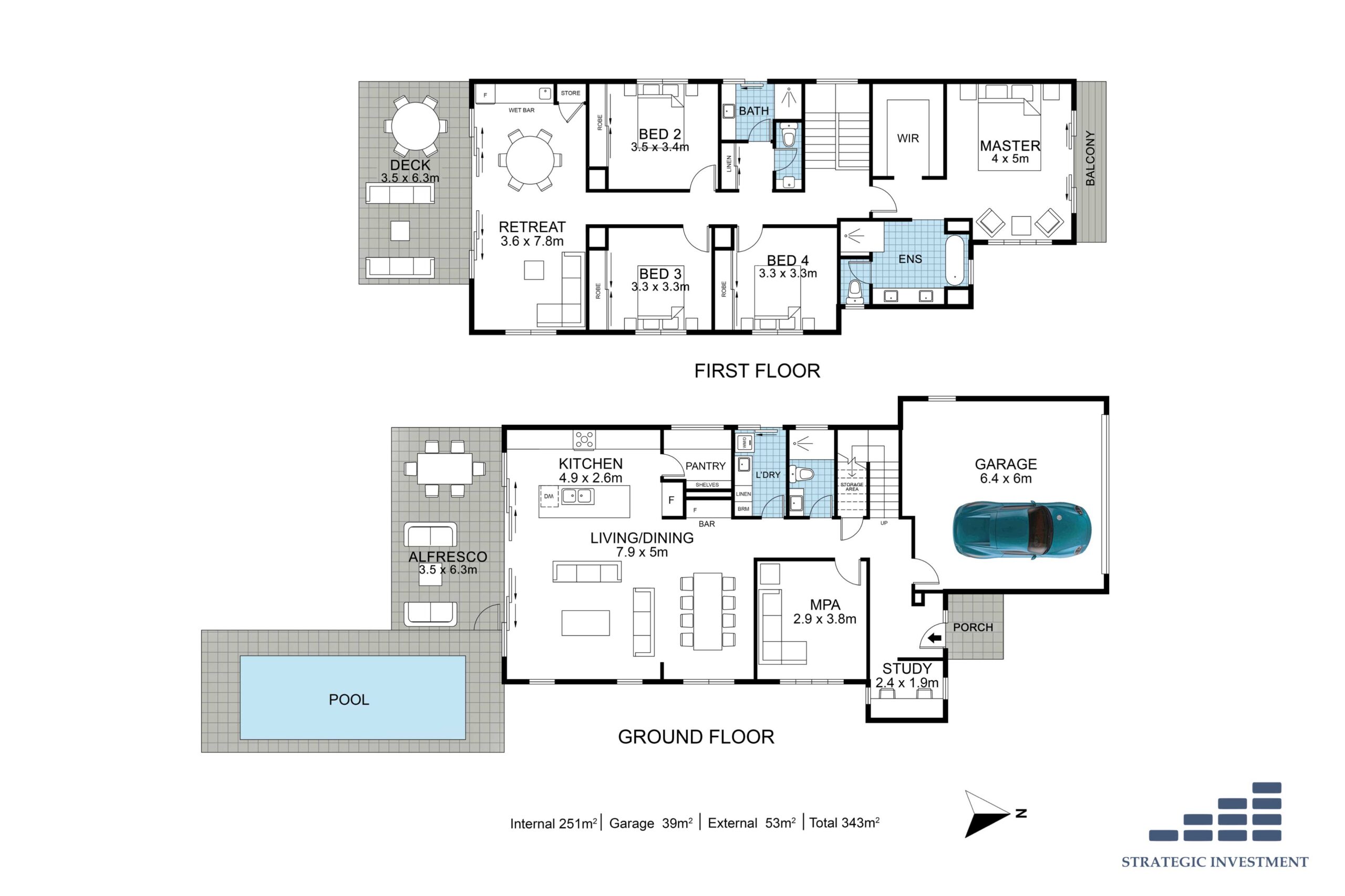

This client had an established portfolio; however, it was limited to two markets that have a track record of being volatile. A Portfolio Review highlighted location risk and performance issues based on some of our 15 Key Investment Drivers. This objective analysis allowed the investor to take action and safely grow their portfolio.

Try our Cashflow Calculator, specifically developed for property investors.

Use the calculatorGet educated and make informed investment decisions on topics such as cashflow, due diligence, market assessment and more.

Learn MoreHave one of our Property Advisors call you to discuss getting started.