23 July 2024

Halfway Through 2024: Rising Interest Rates and Future Opportunities in Australian Property Market

As we hit the halfway mark of 2024, the Australian property market finds itself navigating through a landscape shaped by rising interest rates and shifting economic dynamics. While higher interest rates pose certain challenges, they also present unique opportunities for savvy investors and homebuyers. Here’s an in-depth look at the current market scenario, the forecasts for the next six months, and why there’s still time to secure property before rates potentially ease.

The Current Landscape: Rising Interest Rates

Since the beginning of the financial year, Australia has witnessed a series of interest rate hikes aimed at curbing inflation and stabilising the economy. The Reserve Bank of Australia (RBA) has been proactive in its monetary policy, resulting in higher borrowing costs for consumers. This tightening cycle has inevitably led to adjustments in the property market, with potential buyers reassessing their purchasing power and existing homeowners reevaluating their mortgage commitments.

Market Trends and Insights

Despite the rising interest rates, the Australian property market has shown remarkable resilience. Several key trends have emerged in the first half of 2024:

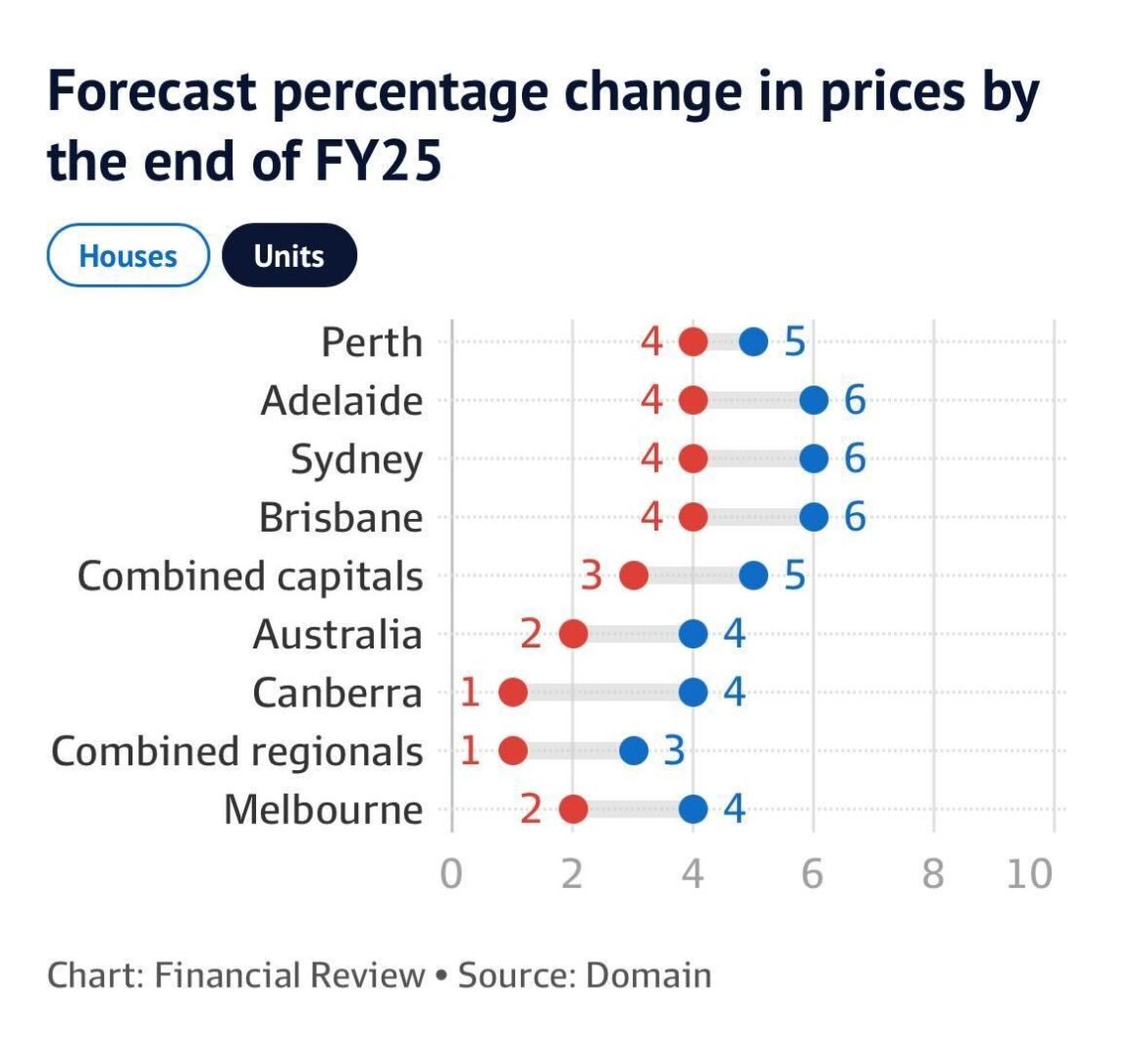

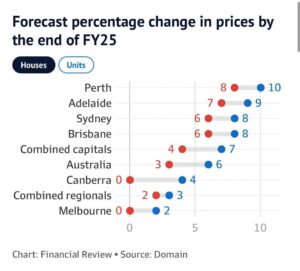

- Moderation in Price Growth: While the rapid price increases of the past few years have tempered, many regions are still experiencing moderate growth. Cities like Sydney and Melbourne have seen a stabilisation in prices, whereas regional areas and smaller capitals such as Brisbane and Adelaide continue to attract strong demand.

- Increased Rental Yields: Higher interest rates have led some prospective buyers to remain in the rental market, driving up demand for rental properties. This trend has pushed rental yields higher, making investment properties an attractive proposition for landlords.

- Supply Constraints: Construction costs and supply chain disruptions have limited new housing supply, maintaining a level of scarcity in the market. This dynamic supports property values, even in the face of rising borrowing costs.

Forecast for the Next Six Months

Looking ahead, several factors are likely to influence the property market over the next six months:

- Interest Rate Trajectory: While further rate hikes are possible, many analysts predict that the RBA will adopt a more cautious approach in the latter half of 2024. If inflation shows signs of easing, we may see a stabilisation or even a slight reduction in interest rates towards the end of the year.

- Economic Stability: Australia’s robust economic fundamentals, including low unemployment and strong GDP growth, will continue to support the property market. As global uncertainties persist, the relative stability of the Australian economy makes it an attractive destination for both domestic and international investors.

- Government Policies: Continued government incentives for first-time homebuyers and investors, along with infrastructure developments, will play a crucial role in shaping the market dynamics. Policies aimed at increasing housing supply and affordability are expected to provide additional support to the market.

Opportunities for Buyers and Investors

Despite the current interest rate environment, now remains a favourable time to secure property in Australia. Here’s why:

- Pre-emptive Buying: Acquiring property before further potential rate increases can lock in current borrowing costs. As rates are predicted to stabilise or decrease in the near future, entering the market now can mean less competition and purchasing before the next boom.

- Negotiation Leverage: Higher interest rates have tempered buyer competition, providing greater negotiation leverage. Buyers can often secure properties at more favourable terms and prices compared to the heated market conditions of previous years.

- Strategic Investments: For investors, the current market presents opportunities to purchase properties with strong rental yields. As rental demand continues to rise, the potential for attractive returns remains high.

|  |

Conclusion: Embracing the Future with Optimism

As we progress through 2024, the Australian property market remains a dynamic and evolving landscape. While rising interest rates present certain challenges, they also open the door to strategic opportunities for buyers and investors. By understanding market trends, leveraging current conditions, and staying informed about economic forecasts, there is ample opportunity to make sound property decisions in the coming months. The key is to act with foresight and confidence, ensuring that you are well-positioned to benefit from any future easing of interest rates.

In summary, the halfway mark of 2024 presents a unique moment in the Australian property market. With careful planning and a positive outlook, there is still time to secure valuable property assets and set the stage for future financial success.