15 Key Investment Drivers: A Practical Guide to Property Investment

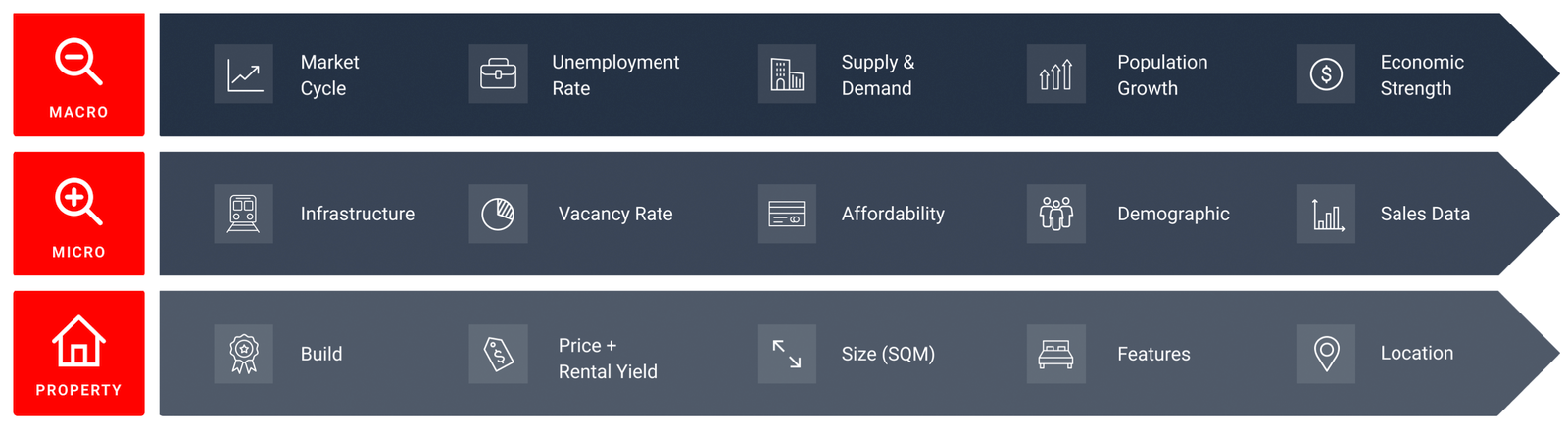

Investing in property is a journey that requires a solid understanding of several key factors. Here at Sound Property, we’ve identified 15 key investment drivers that are essential for any successful real estate investment.

These drivers are grouped into three categories: Macro Drivers, Micro Drivers, and individual Property Drivers.

An explanation of some of these drivers is below:

Macro Drivers

Market Cycles: Impact on Property

Understanding market cycles is crucial, as property values often mirror broader economic trends. Timing your investment to align with these cycles can enhance capital growth and mitigate risks.

Interest Rates: The Cost of Borrowing

Interest rates directly influence mortgage repayments and overall property demand. Lower rates typically stimulate buying activity, leading to price increases, while higher rates can cool the market.

Micro Drivers

Location: The Essence of Value

Location remains a fundamental factor in property investment. Proximity to schools, transportation, and shopping centres can significantly impact a property’s desirability and, ultimately, its value.

Vacancy Rates: A Key Indicator of Demand

Vacancy rates are a strong indicator of rental demand in an area. Low vacancy rates suggest high demand, leading to better rental yields and reduced investor risk.Property Drivers

Rental Yield: Maximising Income Potential

Rental yield, the ratio of rental income to the property’s value, is a crucial factor for

investors focused on cash flow, as it determines income potential relative to the

investment cost.

Build Quality: A Measure of Longevity

The quality of a property’s construction impacts its maintenance costs and long-term

value. High-quality builds are more attractive to tenants and future buyers.

Real-World Example: Applying Investment Drivers to Geelong

To better understand how these key factors underpin successful property investment,

let’s examine how they look for the city of Geelong in Victoria.

Geelong has become a prime example of a regional market that offers solid

investment opportunities driven by a combination of these 15 key investment drivers.

Macro Drivers at Play

Like most property markets, Geelong is strongly influenced by broader economic

trends and market cycles. Many buyers and investors are turning to Geelong, where they can find more affordable options without compromising on lifestyle or amenities.

Micro Drivers: Location and Demand

Location is one of Geelong’s standout factors. The city’s proximity to

Melbourne—just over an hour by car or train—makes it an ideal choice for those

seeking a balance between city and coastal living. Geelong offers the benefits of a

more relaxed lifestyle, with beautiful beaches, reputable schools, and a growing job

market, particularly in healthcare, education, and advanced manufacturing.

Additionally, Geelong has witnessed a significant drop in vacancy rates over recent

years, reflecting strong rental demand. The influx of new residents, many of whom

are priced out of Melbourne’s market, has created a steady demand for rental

properties. This trend is particularly evident in suburbs such as Newtown and

Belmont, where rental properties are highly sought after, ensuring low vacancy rates

and stable rental yields for investors.

Property Drivers: Maximising Returns in Geelong

Investors in Geelong benefit from strong rental yields, especially in suburbs that offer

a blend of affordability and convenience. Areas like Norlane and Corio, while

historically considered lower socio-economic regions, have seen significant uplift as

investors recognise the potential for high rental yields and future capital growth.

These suburbs offer relatively low entry prices while delivering competitive rental

returns, making them attractive to cash-flow-focused investors.

Conclusion: A Solid Investment Destination

Geelong’s rise as a property investment hotspot is a testament to how the 15 key

investment drivers can align to create a thriving market. From its strategic location

and strong market fundamentals to its appealing lifestyle and growth potential,

Geelong demonstrates how a regional city can offer compelling opportunities for

investors.

By understanding and applying these drivers, investors can identify areas like

Geelong that not only promise strong returns but also provide a stable and resilient

market in which to grow their property portfolios.